JENN SLATER

Mortgage Associate

Looking for a Great Mortgage?

I help people across Saskatchewan find the best mortgage product for their unique needs! I would love to work with you!

Understanding mortgage financing can be difficult, it doesn't have to be. Here's the plan!

1

Connect with me

The process starts when you get in touch. Let's take a look at your financial situation and put together a plan to find your perfect mortgage!

2

Discuss your options.

When it comes to mortgage financing, you have options! Let's clarify those options, so you can make the decision that best suits your needs.

3

Arrange the paperwork

Paperwork is the nitty gritty of mortgage financing. I will make sure you know what is required, limiting delays.

4

Lifetime support

Once I've arranged your mortgage, and as long as you need a mortgage, you can trust that I will be there to give you a hand.

JENN SLATER

Hi, my name is Jenn Slater. I’m a mortgage associate with oneSt. Mortgage, a proud franchise of one of Canada’s most well respected Broker Networks, Mortgage Architects. I work from my office in Saskatoon, Saskatchewan. I started my career in finance in the early 2000s and have worked in many advisory positions at major banks and for the credit unions, most recently as a financial planner. I became a licensed mortgage associate because it was important for me to focus my full attention on helping my clients with their unique situations.

My extensive financial experience allows me to see the bigger picture and find solutions and options for my clients that they might not have otherwise found. Working with multiple lenders (instead of just one) has a significant advantage in that I provide incredible options to every client. Each client is different, I understand that and as such take the time to get to know each client individually and provide a mortgage solution tailored to them.

When I’m not assisting my clients finance their dreams, I enjoy ALL kinds of music from country to big hair rock to classical, music is a must while I work. I love pop culture, coffee in the morning, golf in the summer, and a nice glass of red wine anytime! Have a look at my website and contact me when you are ready to talk!

Nice things people have said about working with me.

Get started by completing my online mortgage application.

I'll let you know exactly where you stand so you can proceed with confidence.

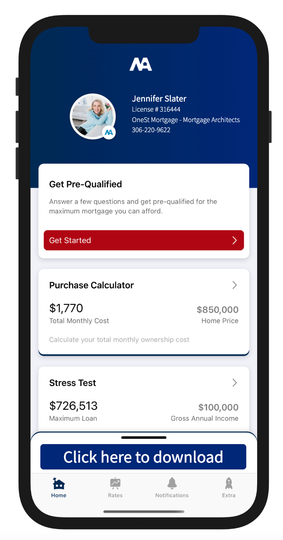

Download my Mortgage Toolbox App

Everything you need,

all in one place

As a trusted mortgage provider, let me help you with these services.

Click through any of the services to learn more